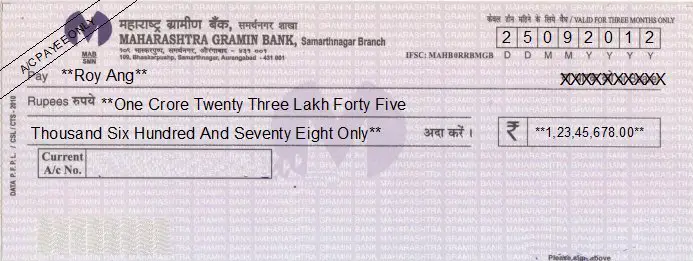

This signature must match the signature on record with your bank, or your cheque will bounce. Add your signatureįinally, you’ll need to sign your cheque in the space at the bottom right-hand corner. These steps help minimise the risk of fraud and confusion. And you should write the first digit close to the pound sign. You must write the amount in both letters and numbers for your cheque to be valid. The amount in here must match the amount you’ve written in words. There’s a small box on the right-hand side where you need to write the amount you’re paying in numbers, including pounds and pence. It’s also common to draw a line through the rest of the amount box after the word “only”. Adding the word only prevents people from tacking figures onto the end of what you’ve written.įor example, £56.23 would be written as Fifty-six pounds and twenty-three pence only.

You’ll need to write the amount you're paying in full, followed by the word “only”. However, some banks reject cheques over six months old to prevent fraud. Under UK law, cheques don’t expire for six years. However, be aware that the recipient might succeed in cashing it before this date, so it’s best to ensure you have enough money in your account, just in case. You could also post-date it if you’re giving someone money for their birthday. This can be helpful if you’re waiting for money to go into your account.

Doing this will prevent the recipient from cashing it until that date.

You can also choose to post-date your cheque by writing a date in the future. You need to include the day, month and year so there’s no confusion. The date is usually the day you’re writing the cheque. Detailed guide for filling out a cheque 1.

0 kommentar(er)

0 kommentar(er)